Trust is key

Investment & finance

‘Eurobuild CEE’ magazine: How long will the era of so-called cheap money last? What might make central banks change direction and start raising interest rates?

Jan Antony Vincent-Rostowski: I believe that the era of so-called cheap money is still going to last a long time. When you consider the very low levels of economic growth and, more importantly, the low inflation rate, there’s no cause for central banks to increase nominal interest rates. Real interest rates are being held down by demographic causes (ageing societies tend to save more) as well as by the lack of a sufficient number of high yield investment opportunities. This second reason is probably a result of the current nature of technological development, which requires little capital. The only exception on the horizon is the Federal Reserve of the United States, which might increase interest rates by 0.25 pct in December. However, this would have more of an effect on the dollar exchange rate than it would on global interest rates. And a further rise in US interest rates would be very slow.

What would the consequences be of a sudden increase in interest rates on the Polish economy?

I’m not expecting anything like that to happen. An Increase in interest rates could only be justified in the event of a collapse in the exchange rate of the złoty resulting from a complete loss of confidence in the current government on the markets or as a result of a major European political crisis. Even though we are paying a lot for the new government’s lack of credibility (the interest rate on Polish treasury bonds is much higher than that of our neighbours), there’s no indication that there will be a total collapse in confidence in the actions of the Law and Justice party. I’m more concerned about geo-strategic threats and the fact that the current government chooses to exacerbate rather than counteract them and is putting us into conflict us with all our friends and partners.

What might the impact of Brexit be on the Polish economy (if any)? What in your opinion was it that made the Brits vote to break away from the EU?

The result of the referendum was due to the lies that the supporters of Brexit told about Great Britain’s membership of the EU and about Brexit itself. For example they claimed that the UK would be able to save GBP 350 mln a week on leaving the EU and that they would still be able to access the EU’s common market while limiting immigration from Europe (including from Poland). The referendum resembled last year’s presidential and parliamentary elections in Poland and the current presidential election in the USA. Nowadays democracies are proving insufficiently resilient to lies and empty promises. As far as the impact of Brexit on the Polish economy is concerned, Brexit destabilises all of Europe both politically and geo-strategically. If Donald Trump wins the US elections, this could together with Brexit, lead to a further disintegration of the EU. The results of such a turn of events would be extremely dangerous in geo-strategic terms with economic consequences for Poland. The EU and NATO are the basis of our security and independence. And if the EU starts disintegrating and if NATO also becomes fundamentally weakened, then what investor, local or foreign, would want to invest in Poland under such circumstances?

The Polish economy has been growing due to domestic demand and exports. The third driver – investment – has weakened slightly. Could you make a few proposals that might improve Poland’s ability to attract investment?

The current government’s attack on the independence of the judiciary and in particular on the Constitutional Tribunal constitutes the most serious threat to investment in Poland. Nobody is prepared to invest on a large scale in a country where you cannot trust the independence of the courts or the government’s respect for the law. There is no efficient market economy without the rule of law.

How could and should the state support the real estate market and why should it do so? (Maybe what’s really needed are investors, large tenants and employers?)

It would be better to remove the barriers to doing business rather than support certain sectors, which is always done at the cost of others and of the taxpayer. That is why we wanted to provide investors and tenants with a greater sense of certainty by introducing a system of occasional leases into Polish law and by simplifying the tax code. I believe that this is a better way than increasing the number of various benefits.

Will the state of Polish public finances allow the Polish economy to grow? Should investors keep public finances in mind when investing in Poland?

The greatest threat to Poland’s development is the fact that there won’t be enough money for both the electoral promises of the Law and Justice party and for co-financing EU infrastructure projects. The Law and Justice party, in spite of its rhetoric, is currently focusing on pleasing its own electorate rather than the developmental needs of the country. Besides, they admit themselves that they’re expecting to catch up with Europe at a much slower pace than we have seen over the last eight years. If Poland were catching up with the EU at the same pace as when we were in power, we would reach the goal of equalling the EU wage average by 2025 in instead of development minister Mateusz Morawiecki’s target of 2030!

The era of special economic zones has been slowly coming to an end – should their operations be prolonged? Are they justified and are they profitable?

I’ve always been sceptical about special economic zones. Firstly, they're mostly to the benefit of foreign investors. Even though I am opposed to the policy ideas that the Law and Justice party has to discriminate against foreign investors, I’m even more opposed to discrimination that favours them. Moreover, even when there are Polish companies in the zones, there shouldn’t be discrimination that gives those that managed to set up in the zone an advantage over those that have remained outside its limits. It’s time to gradually wind the zones down, particularly when you consider that due to the infrastructure we built, we have an unemployment rate that is significantly lower than the EU average and is at its lowest since the collapse of communism.

A guide through times of crisis

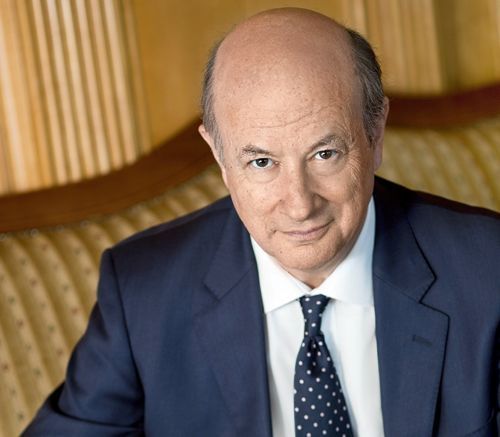

Jan Antony Vincent-Rostowski is the former deputy prime minister and was minister of finance from 2007 to 2013. He was Poland’s longest serving finance minister. During the period when he held office, which also included the time of the financial crisis, Poland recorded the fastest economic growth of any European and OECD countries. As the Polish minister of finance he participated in sixty meetings of the Economic and Financial Affairs Council (Ecofin) and as a result is familiar with the workings of the EU. He also served as the President of the Council at the height of the eurozone crisis. Before being appointed minister in 2007, he served as the senior advisor to the minister of finance, the president of the National Bank of Poland and also president of the board of Bank Pekao, as well as being an academic. He is currently the president of the council of the Modern Liberalism Foundation in Warsaw. On November 25th, he is to be a guest of Eurobuild Conferences and will open the 22nd Annual Commercial Property Market Conference by answering questions from reporter Piotr Kraśko.