CIT and the real estate investor

The planned amendment to the act on corporate income tax (CIT) could have a significant impact on the effective tax on real estate investment in Poland for a number of reasons.

Firstly, it introduces restrictions on the deduction of taxable income from the interest on bank loans taken out in order to purchase properties. These costs constitute a highly significant factor in the calculation of CIT tax. Interestingly, the restrictions would not include the interest paid by alternative investment funds (AIF), so the types of investment that would be subject to the AIFMD (Alternative Investment Fund Managers’ Directive) would be impacted by the amendment to a lesser degree.

Limiting the possibility of including expenditure on non-material services – such as consulting or management services – in the tax rate levied seems completely unjustified. According to the Ministry of Finance, such expenditure does not constitute remuneration for actual services but is rather a percentage of the capital involved, received by the foreign parent company. It is impossible to agree with such an assessment because the tax law already includes a number of mechanisms that deter such practices. So the proposed regulation would not remove tax avoidance but would instead result in an increase in effective tax without increasing the tax rate.

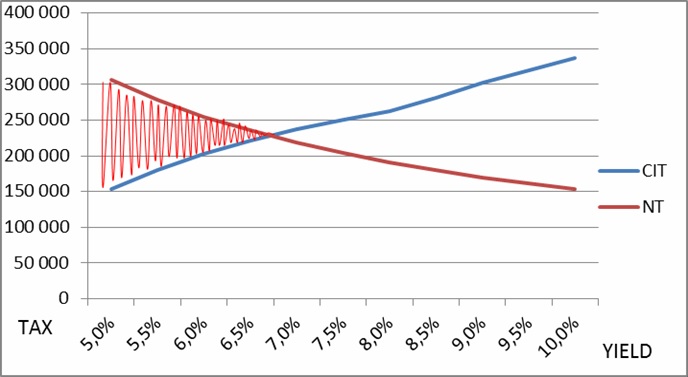

The introduction of a minimum CIT tax on commercial properties would have the same effect. The Ministry has declared that the introduction of a minimum annual tax rate of 0.5 pct of the cost of property purchases would only result in an increase in tax if aggressive tax optimisation techniques are used. However, this argument does not hold water. The introduction of a minimum CIT rate could result in an actual increase in tax on investments with yields of up to app. 6.7 pct. Without the application of any optimisation techniques, these properties would incur an annual CIT tax of at least 0.5 pct of their initial value. Only after the yield exceeded 6.7 pct would the annual CIT be more than 0.5 pct of the initial value of the property.

This phenomenon is illustrated by the chart below, for properties with NOI of PLN 3.6 mln per year, where the red line (NT) signifies the new tax.

An open door to redefining the commercial real estate market in Poland

An open door to redefining the commercial real estate market in Poland

The investment slowdown in the commercial real estate sector that we have been observing in Poland for over a year is primarily the result of the tightening of monetary policy arou ...

Walter Herz

The retail sector is not slowing down

The retail sector is not slowing down

The pandemic, conflict in Ukraine as well as inflation and high interest rates that recent years have brought have reshaped the real estate market around the world. The global slow ...

Walter Herz

Retail parks – current opportunities

Retail parks – current opportunities

Over the last few years, retail parks in Poland were mostly developed in smaller formats, around 5,000 sqm, either adding to the existing retail landscape or introducing modern ret ...

Avison Young